SBAB Year-end Report 2024

SBAB’s Year-end Report 2024 is now available for download on sbab.se/IR.

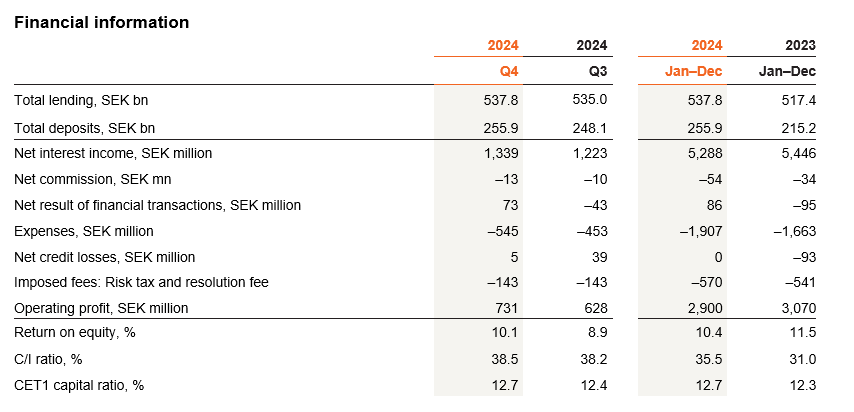

Q4 2024 (Q3 2024)

- Total lending increased 0.5% to SEK 537.8 billion (535.0). Total deposits increased 3.1% to SEK 255.9 billion (248.1).

- Operating profit grew to SEK 731 million (628), primarily due to an increased net interest income and a more positive outcome for net income from financial transactions. The trend was offset somewhat by higher costs.

- Net interest income grew to SEK 1,339 million (1,223), mainly driven by higher mortgage margins.

- Net credit losses amounted to recoveries of SEK 5 million (recoveries: 39). Confirmed credit losses totalled SEK 4 million (4).

- The return on equity amounted to 10.1% (8.9) and the C/I ratio was 38.5% (38.2).

- The Common Equity Tier 1 (CET1) capital ratio was 12.7% (12.4).

January–December 2024 (January–December 2023)

- Total lending increased 3.9% to SEK 537.8 billion (517.4). Total deposits increased 18.9% to SEK 255.9 billion (215.2).

- Operating profit decreased to SEK 2,900 million (3,070), primarily due to lower net interest income and higher costs.

- Net interest income fell to SEK 5,288 million (5,446), primarily driven by shrinking deposit margins. The trend was offset somewhat by higher deposit volumes.

- Net credit losses decreased to SEK 0 million (loss: 93), mainly due to lower credit loss allowances. Confirmed credit losses totalled SEK 14 million (loss: 9).

- The return on equity amounted to 10.4% (11.5) and the C/I ratio was 35.5% (31.0).

- The Common Equity Tier 1 (CET1) capital ratio was 12.7% (12.3).

- The basis for the Board regarding appropriation of profits for 2024 is to propose a dividend of SEK 913 million, representing 40% of the Group’s net profit for the year after tax, in accordance with SBAB’s dividend policy.

CEO statement from Mikael Inglander

We continue to grow the business and we are proud that so many customers are turning to us to finance their homes or to manage and get a return on their savings. For 2024, we posted a stable financial performance, continued good credit quality in lending and the sector’s highest level of customer satisfaction. The interest rate cuts by the Riksbank create the preconditions for increased housing market activity and a broader general recovery for Sweden’s economy.

Lower inflation and lower policy rates

High cost increases and significantly higher interest rates in the past few years have entailed tough times both for households and for businesses in Sweden. We are pleased to note that inflation was back on target at the end of 2024 and that the Riksbank has therefore started to cut the key policy rate. The Riksbank lowered the policy rate on several occasions during the year by a total of 1.5 percentage points from 4.0% to 2.5%. If the outlook for the economy and inflation remains unchanged, the Riksbank believes that the policy rate will be cut further during the first half of 2025. Some believe that the Riksbank is exercising too much caution in its forecast and may need to lower rates even further to support growth in a weak economy. Geopolitical and political developments are generating some uncertainty. In January 2025, the RIksbank decided to cut the key policy rate by an additional 0.25 percentage points to 2.25%.

The housing market gradually improved in 2024, in pace with falling interest rates. In 2024, housing prices rose an average of 4.2% in Sweden as a whole. The largest price increase was for apartments at 7.1% compared with 2.1% for houses. Despite the upturn, housing prices average just over 11% below their peak in spring 2022, according to the SBAB Booli Housing Price Index (HPI). Household mortgage borrowing grew 1.4% in 2024, which albeit a year-on-year increase was still low by historical standards. Lending to property companies increased 6.3% during the year, while lending to tenant-owners’ associations decreased 0.6%.

We are growing our volumes and capturing market shares

Despite challenging conditions, with low market growth and a highly competitive mortgage market, SBAB has captured a very large share of the net mortgage market growth in 2024. During the year, we increased our market share from 8.40% to 8.76%.

Our total lending amounted to SEK 537.8 billion at the end of the year, corresponding to growth in 2024 of 3.9%. Given the conditions, this represents a good rate of growth and one that we are pleased with and aligns with our long-term ambition to grow our lending volumes toward 2030. At the same time, falling interest rates are expected to increase demand for housing, thereby supporting growth in 2025 and beyond.

We are proud that so many customers are turning to us to finance their homes. We are also proud that customers are increasingly turning to us to manage and get a return on their savings. In the fourth quarter, our total deposits passed SEK 250 billion, just over one year after we passed the SEK 200 billion milestone. And we have achieved this in a period where the market as a whole grew 2.3% for households and shrank 0.5% for corporates and tenant-owners’ associations. During the year, we invested significant time and resources in continuing to improve our offering, not least within fixed-term deposits, but also by building other functionality that makes it even easier for our customers to save their money with us. We also continuously endeavour to make our offering visible in the market. It is gratifying that our joint efforts have borne fruit and that we continue to challenge ourselves as well as the market in general, including the major banks, which often offer their customers substandard interest rate terms. Our ambition is to continue to grow deposits as they create substantial value for our customers as well as boost our long-term capacity to achieve the targets we have set for 2030.

Sweden’s most satisfied customers

I humbly note that, for the sixth consecutive year, we had Sweden’s most satisfied residential mortgage customers according to Swedish Quality Index (Svenskt Kvalitetsindex). According to the same survey, for the seventh consecutive year, we also had Sweden’s most satisfied customers within property loans to tenant-owners’ associations and property companies. It is clear that our brand, our service model and our know-how in each business area in combination with the simplicity, transparency and accessibility that denote SBAB and our offering, are appreciated by our customers. These attributes have also been confirmed by the Swedish Quality Index (SKI), which stated that customers today have higher requirements in terms of service, proactivity and relevant information than before. SKI also highlighted that our transparent mortgage rate-setting model means we are perceived as more transparent in our pricing than many other market players. Really great.

Booli has more people than ever using it and a wide range of properties. Traffic to Booli increased significantly in 2024 to over 100 million visits. We continue to develop products and services in housing and household finances with the aim of creating a comprehensive offering that is unique in the market. Booli continues to have the largest offering of homes for sale in the market.

Stable full-year performance and good credit quality

After a somewhat weaker third quarter in terms of earnings, we posted a slight recovery for the last quarter, which was supported by growing business volumes both for deposits and for lending. Pressure on mortgage margins and intense competition have been and remain a challenge. Overall, we posted stable full-year earnings, with a return on equity of 10.4%, which exceeded our owner’s profitability target of 10%.

The lending portfolio’s overall credit quality remains very good, as shown by our reported figures and key metrics in 2022, 2023 and now also in 2024, despite the great pressure that households and corporates have been under. Net credit losses totalled SEK 0 million for the full year. The proportion of non-performing loans remained low and amounted to 0.16% of total lending at year end. Given our focus on mortgages and housing finance, this strong performance is not surprising in itself, but it is nonetheless clear evidence that we run a stable, responsible business and that the assets in our balance sheet are of high quality.

Costs continued to increase as planned due to our continued investments in the business to enable future growth and a strong customer offering. The C/I ratio in 2024 amounted to 35.5%. We work in line with our target areas and long-term strategic objectives with a focus on growth, long-term value creation, being an attractive workplace, sustainability and high operational efficiency.

I look forward to an exciting and positive 2025 and would like to take this opportunity to extend my sincere appreciation to all the fantastic employees at SBAB. Last but not least, don’t miss the latest episode of Household finances are really fun, available on a channel close to you.

Mikael Inglander

CEO of SBAB

For more information, please contact:

Catharina Henriksson, Head of Press SBAB

Telephone: +46 76-118 79 14

E-mail: catharina.henriksson@sbab.se